Engagement & Retention project | Nykaa

For the purpose of this assignment the entity 'Nykaa' - from hereon refers to the

- Nykaa e-commerce beauty platform,

- Content+ media house + Owned brands

- Nykaa owned brands ( on the ecommerce platform)

Remember 2016?

You saw that perfect lipstick on your favorite influencer, heart racing, thinking, “I have to get this!” 💄

But then… reality hit.

You searched plenty of stores in your area, on foot!

Made a lot of phone calls to shops located all over the city.

And guess what ? That shade? Not available. 😩

The ones you did find? Either made you look like a clown 🤡 or didn’t match your complexion at all.

So, what did you do?

Begged your cousin flying in from the US to bring it for you, of course. ✈️

Enter Nykaa 💥!

No more waiting, no more praying your shade will show up.

Nykaa brought the global beauty revolution right to India! 🌍✨

From the latest makeup trends to skincare that actually works for Indian skin tones, Nykaa had it all. No more FOMO, no more guessing — just beauty delivered to your doorstep. 🛍️

Where beauty meets convenience – thanks to Nykaa ! 🙌💋

Section at a Glance :1. Background of Product ( Nykaa)

2. Understanding Product (Nykaa)

👉Brief Background about the Product

👉Core Value Prop of the Product

3. Understanding Engagement with Product ( Nykaa)Broad Overview

👉How are users currently experiencing the core value prop?Mircoscopic View

👉Natural frequency of the product?

👉Are there any sub products? What are their natural frequencies?

👉What is the best engagement framework for the product?

4. Defining Engagement for Product (Nykaa)

👉Who is an active user?

Section at a Glance :1. Background of Product ( Nykaa)

2. Understanding Product (Nykaa)

👉Brief Background about the Product

👉Core Value Prop of the Product

3. Understanding Engagement with Product ( Nykaa)Broad Overview

👉How are users currently experiencing the core value prop?Broad Overview

Mircoscopic View

👉Natural frequency of the product?

👉Are there any sub products? What are their natural frequencies?

👉What is the best engagement framework for the product?

4. Defining Engagement for Product (Nykaa)

👉Who is an active user?

1. Background

What is Nykaa ?

- Nykaa is India’s leading e-commerce platform for beauty and personal care that serves as a one stop destination for the latest and most trending beauty products.

- Built to empower shoppers to explore and embrace the transformative power of makeup, beauty & personal care.

What is unique about Nykaa?

- Nykaa's BPC ( Beauty and personal care ) offering is extensive, with about 200K stock-keeping units (SKU).

- Extensive spread across a range of nearly 2500 worldwide, local, premium, and niche brands.

- Additionally, It sells things under its own label.

How does Nykaa work?

- Nykaa works on an inventory-based business model.

- The company purchases the products directly from the manufacturer and stores them in its warehouse.

- This model enables the firm to provide identification for all its items and ensures availability and prompt delivery.

What does Nykaa's product porfolio comprise of?

Note : The male product line has been added to secondary in this case as Nykaa Man is an app in itself catering to this audience in depth.

Note : The male product line has been added to secondary in this case as Nykaa Man is an app in itself catering to this audience in depth.

Nykaa's portfolio's GMV split % in 2024.

Nykaa's portfolio's GMV split % in 2024.

Now that we know a fair bit about what the product is, let's understand its uses and features.

2. Understanding the Product

2. Understanding the Product

1️⃣ What is the core value prop of Nykaa?

To understand the core value proposition of Nykaa let's look at its communication across different channels

For beauty enthusiasts wo demand high-quality, authentic beauty products, Nykaa, an online beauty and wellness platform offers a wide range of genuine, personalized, and highly effective beauty products allowing individuals to experience the magic of beauty and makeup through a seamless shopping experience, fast delivery, and excellent customer service. 💅💄

What are some problems Nykaa solves?

👉 Limited Product Variety

👉 Inconvenient Shopping Experience

👉 Concerns over product quality and Authenticity

👉 Pricing

👉 Lack of personalized beauty advice

👉 Difficulty finding beauty products of their choice ( pre Nykaa- offline was the only option)

👉 Unavailability of beauty products in remote areas

👉 Lack of Beauty Product education

👉 Limited Access to International brands

👉 Overwhelming number of choices

👉 Unclear product details & descriptions

How does Nykaa solve for these problems through its CVPs ( core value props)

3. Understanding Engagement with Product

Broad Overview

How does a user experience the core proposition of Nykaa repeatedly?

By successfully placing orders on Nykaa mobile apps multiple times a week/month/year to meet their beauty, makeup, personal care, fashion shopping needs and experience the CVPs o Nykaa.

Core Value Experience Points in the User Journey

- Browsing & Discovery

User lands on the Nykaa app and sees a wide variety of beauty, skincare, and wellness products.

Personalized recommendations and curated collections help users navigate options quickly.

Wishlist & Price Drop Alerts encourage users to save products and return later.

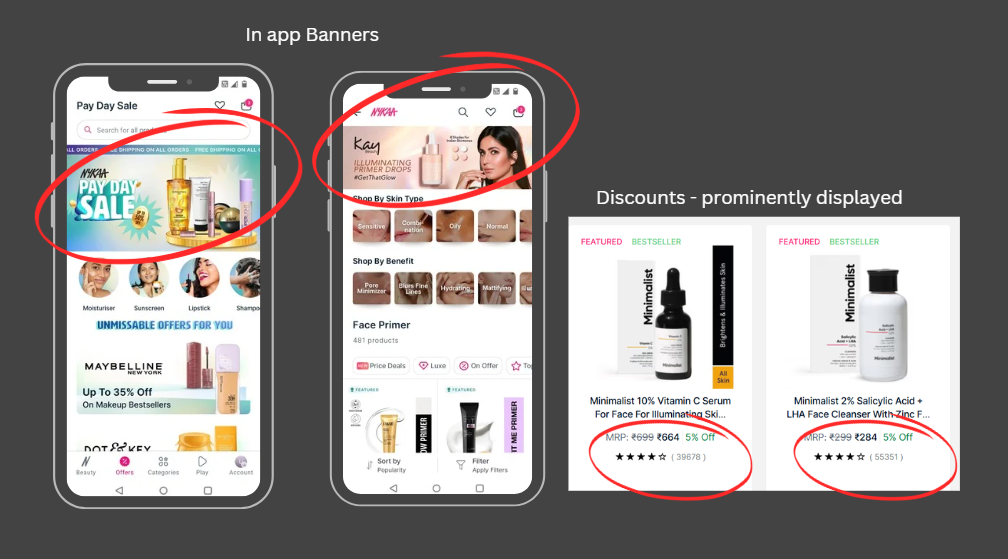

Discounts & Affordability

Users see exclusive discounts, offers, and sale banners prominently displayed.

Nykaa reinforces its affordability with reward points, free shipping offers, and bank discounts.

Trust & Quality Assurance

User checks product details, ingredient lists, authentic reviews, and Nykaa's ‘Genuine Products’ badge for assurance.

Tutorials, influencer reviews, and expert recommendations boost confidence in purchase decisions.

Seamless Checkout & Payment Options

One-click checkout with saved addresses, wallets, UPI, and COD for a frictionless experience.

Instant order confirmation and expected delivery date displayed upfront.

Order Tracking & Fast Delivery

Real-time tracking and estimated delivery updates keep users engaged post-purchase.

Express delivery options for urgent purchases reinforce convenience.

Post-Purchase Engagement

Easy returns & customer support provide a safety net, increasing trust.

Post-purchase notifications encourage users to review products, earn reward points, and reorder essentials.

Nykaa sends personalized restock reminders and curated recommendations based on previous orders.

Loyalty & Retention

Nykaa Privé membership, reward points, and sale previews make users feel exclusive.

Frequent users get early access to discounts, free gifts, and birthday offers, reinforcing habit formation.

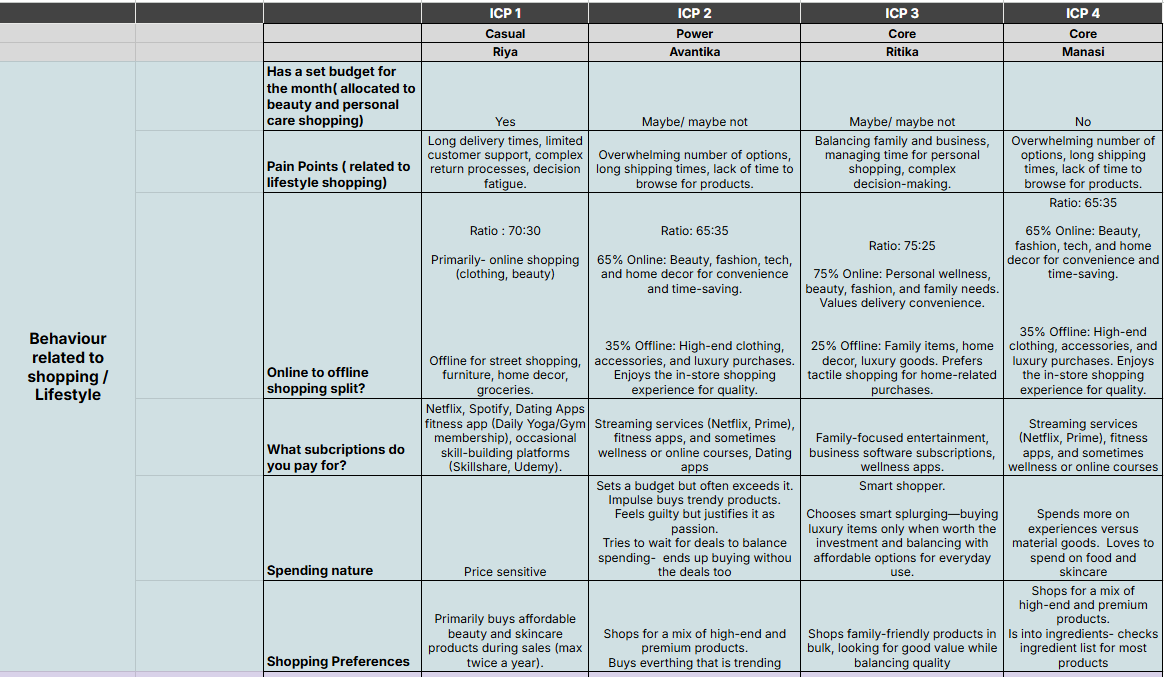

The app has 4.4 rating- high up on the rankings of the play store - thanks to its well thought through onboarding and interface.

The app has 4.4 rating- high up on the rankings of the play store - thanks to its well thought through onboarding and interface.

Microscopic View

What is the natural frequency of Nykaa?

- The natural frequency of Nykaa’s core product is the frequency at which users visit the platform to browse, shop, or explore beauty and wellness products.

- The natural frequency may vary depending on the user’s preferences, shopping habits, beauty needs, and the desire to discover new products or restock essentials.

- Since frequency is dependent on shopping habits and user preferences - it is important to understand user needs first to arrive at the frequencies.

Note : Since the core action of Nykaa is purchase, we will be analyzing/ segmenting only basis purchase behavior.

Steps followed to arrive at the natural frequency for Nykaa:

👉Split the base into Casual, Core, Power users first

👉Understand by definition what each of them means

👉Understand the JBTD by Nykaa for each of the user base

👉Finally arrive at the natural frequencies for each user type

Basis user's purchase behavior and segregation into Casual, Core, Power categories their frequencies would look somewhat like this:

Subsequently let's also analyze some of the triggers to justify the natural frequency of the said user base.

Inferences drawn from this mapping of triggers:

Case 1: Core User 👩🦰 🌟

A core user will purchase every month to restock on supplies that have the life cycle of a month.

Here is a hypothetical scenario of a Core User - Ritika and her purchase for month of December 2024

She ran out of her staples that comprise of :

- Eyeconic Eyeliner

- Bodywise salicylic acid Body wash

- Pilgrim Anti Hair fall Shampoo

- Minimalist Niacinamide Serum

Case 2 : Power User 👩🦰🌟🌟

A power user may purchase multiple times a month

Here is a hypothetical scenario of a Power User - Avantika and her purchase for month of December 2024

- First time - to restock

- Second time - to buy the latest launch of Loreal Vinyl Lipstick

- Third time- Social proof ( watched a video of an influencer rave about a product on Instagram and now definitely wants to try it.)

- Fourth Time - She would have drawn out pricing patterns and seen a steal deal on a particular product and decided to purchase yet again the same month!

Does Nykaa have any sub products?

Here's a list of Nykaa's products ( sub & adjacent)

What is the natural frequency of the sub products?

What is the best engagement framework for Nykaa?

Steps followed to arrive at the best engagement Frameworks for Nykaa :

👉Analysis of the different engagement frameworks available

👉Understanding what each framework means in the context of Nykaa

👉Parameters that make it the best engagement Framework for Nykaa

Here's what each of the engagement focuses mean, the metrics tracked for each of them and the value they hold in the context of Nykaa:

Now that we have a clear understanding of frameworks + context for Nykaa, let's evaluate what's the best framework-

For Nykaa, purchasing products is the core feature.

Thus the best engagement framework must meet the following criteria

- Bring user closest to the core feature

- Solve for 80% of the user base

Metrics that signal this are:

- Number of times ordered ( Frequency)

- AOV ( Depth)

Number of times ordered reflects how often a user interacts with the platform, indicating their level of habitual engagement.

AOV or money spent is a function of frequency, price, quantity, and category being ordered. A user might make a high-value purchase once but not return for a long time.

In contrast, frequent visits shows sustained interest and engagement.

Hence AOV is not the right measure of engagement for Nykaa when it comes to the core feature of purchase.

However it is important to note that for Nykaa, all three engagement framework Frequency, Depth and Breadth are crucial, as each provides unique insights into how engaged a user is:

- Frequency reflects how often a user interacts with the platform, indicating their level of habitual engagement.

- Depth Even though AOV is not correct, Avg sessions time is a good metric to understand consumer engagement. Exploring complementary items, reviews, or tutorials adds depth by enriching the user experience and increasing basket size and could directly and indirectly increase frequency too.

- Breadth Engaging with multiple categories indicates a holistic use of Nykaa. It suggests that the user is not just there for a specific purpose but is also influenced by the platform's content and additional offerings, enhancing their overall shopping experience.

Hence Frequency should be the primary engagement Metric for Nykaa

Depth and Breadth should be secondary. These should not and cannot be neglected!!

4. Defining Engagement for Product

Who is an active user of Nykaa?

Core Action

A user qualifies to be an active user if they place orders ( without returning) on Nykaa for a period of 3 months consecutively.

Sub Actions

While not the primary goal these indicate their interest and interaction with Nykaa (Beauty and Personal Care)

These are valuable behaviors, but they don’t make a user fall under the classification of an active user:

Section at a Glance :1. Understanding Segmentation types in the context of Nykaa2. Selecting the right customer segmentation framework for Nykaa3. Understanding users in depth through the selected segmentation frameworks

1. Understanding segmentation types in the context of Nykaa

1. Understanding Segmentation types in the context of Nykaa2. Selecting the right customer segmentation framework for Nykaa3. Understanding users in depth through the selected segmentation frameworks

3. Understanding users in depth through the selected segmentation frameworks

2. Selecting the right customer segmentation framework for Nykaa

Since frequency is the best engagement framework, our user segmentation must highlight this data effectively.

This rules out:

❌ Revenue-based segmentation - Doesn’t capture frequency

❌ Product feature segmentation - Doesn’t capture frequency

Moreover, natural frequency shows no more than what it already captured in Advanced Segmentation & Casual, Core & Power segmentation hence we will be ruling this out too.

❌ Natural frequency segmentation - Overlaps with Advanced & Core-Casual-Power, making it redundant.

CCP ( casual core power) segmentation has some overlap too with advanced however it is important to retain both as

👉Advanced segmentation tells you where the user is in their lifecycle (new, growing, or loyal).

👉Core, Casual, and Power segments give you a clearer view of how these users engage with Nykaa.

👉By pairing the insights from Advanced with CCP, we can more accurately time your campaigns to keep users moving forward through their lifecycle.

Thus the segmentation types selected are:

1. ICP/Persona-Based Segmentation

Humanizes engagement by adding user motivations, by capturing user pulse, personality, and shopping behavior.

Understanding these nuances makes communication feel more personal, relatable, and engaging, ultimately driving higher retention and stronger brand affinity with Nykaa that increase conversions.

2. Advanced Segmentation

Tracks user lifecycle (New, Growing, Loyal), helping optimize retention & re-engagement campaigns at the right stage.

3. Core-Casual-Power Segmentation

Defines frequency-based engagement tiers, showing who shops occasionally vs. consistently, helping structure targeted nudges.

3. Understanding users in depth through the selected segmentation frameworks

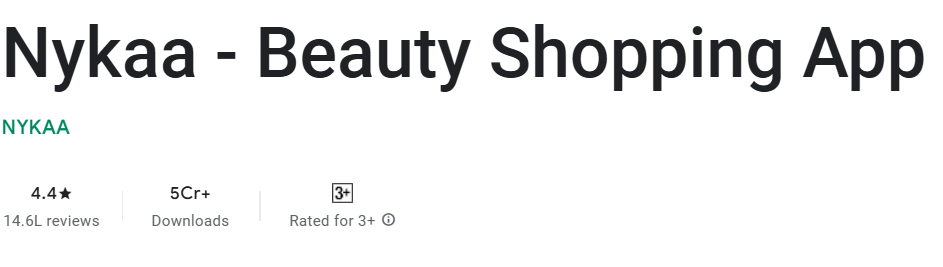

Segmentation 1: Ideal customer persona ( ICPs)

Process followed to arrive at the Ideal Customer Personas ( ICPs ) for Nykaa

👉Step 1: Conducting Qualitative Research by talking to users.

👉Step 2: Logging user call data

👉Step 3: Analyzing insights gathered from calls

👉Step 4: Mapping out ICPs

The following users were called :

User call data + learnings from these calls has been tracked here-

( Here's a snippet of the same)

Basis all the information gathered through calls,

👉Potential ICPs for Nykaa look like this :

ICP deepdives

ICP 1 - Riya | Casual user

- Price-sensitive shoppers who mainly purchase during sales, looking for discounts.

- Low purchase frequency, shopping only 2-3 times a year, primarily during sales.

- Average Order Value (₹1500-2500) suggests they prefer maximizing savings per purchase.

- Brand loyalty exists but will switch for better discounts elsewhere.

- Fast delivery is critical, long wait times lead to user to churn

- Decision fatigue due to large product catalog; personalized recommendations could boost conversions.

- Spends more on fashion, entertainment, and travel, so beauty must be part of their lifestyle.

- Pays for subscriptions like Netflix and Spotify; Nykaa could offer loyalty programs to increase retention.

- Prefers online shopping (70%) but still shops offline for street fashion, groceries, etc.

- Potential for higher engagement with well-timed pushes and personalized offers.

ICP 2 - Avantika | Power user

- Highly engaged shopper with high purchase frequency (18-20 times a year), indicating strong interest in beauty and skincare.

- Buys a mix of high-end, premium, and budget-friendly products, making her a balanced but aspirational spender.

- Impulse-driven shopper. Frequently buys trendy products even if they’re not on sale, indicating a passion for newness.

- Seeks convenience and variety, using Nykaa for exclusive products and premium brands.

- AOV of ₹2500-5000 reflects willingness to spend more on quality and premium beauty products.

- Prefers online shopping for time-saving, but still shops offline for high-end, in-person experiences for clothing and luxury purchases.

- Will leave Nykaa for competitors if there are better deals or faster delivery, signaling a need for exclusive deals or perks.

- Values both money and quality, likely to justify splurging on makeup as a passion, not just a necessity.

- Shops for herself predominantly, but occasionally buys gifts, making her a potential ambassador for the brand among friends and family.

- Pain points include overwhelming options and shipping delays; Nykaa could improve by offering curated recommendations and faster delivery options.

ICP 3 - Ritika | Power user

- Frequent shopper (12-15 times a year), indicating regular but thoughtful purchasing behavior for family needs.

- Primarily buys products for the whole family, making bulk deals and value-for-money important, with an AOV of ₹3500-6000.

- Seeks quality products for her family, prioritizing trusted brands like The Body Shop, Kama Ayurveda, and Mamaearth.

- Splurges on luxury items only when deemed worth the investment, balancing with affordable everyday options.

- Prefers online shopping (75%) for convenience, especially for beauty, wellness, and family products, but enjoys tactile in-store shopping for family and home items.

- Shopping mainly happens on the mobile app, with occasional website use, suggesting ease of access and mobile-centric behavior.

- A combination of quality and price-consciousness; values both high-quality brands for family and cost-effective solutions for everyday needs.

- Pain points include balancing personal and family shopping with decision fatigue; could benefit from curated, easy-to-navigate shopping experiences.

- Likely to switch to competitors for better bulk pricing or if product availability is inconsistent, indicating high price sensitivity and need for reliability.

- Shops for her entire family, making family-friendly bulk options and discounts on premium brands highly appealing for retention.

ICP 4 - Manasi | Power user

- Shops 12-15 times a year, suggesting a consistent interest in beauty, skincare, and wellness, but not frequent enough for habitual buying.

- Primarily purchases beauty products, skincare, wellness items, and occasionally makeup, with a focus on ingredients and premium brands.

- Seeks a mix of high-end and premium products, with trusted brands such as Minimalist, Cetaphil, The Body Shop, and Forest Essentials.

- Strong preference for online shopping (65%) for convenience and time-saving, while enjoying offline shopping for luxury items.

- Highly values time over money, indicating a preference for easy and fast shopping experiences over seeking the best deals.

- Uses the mobile app for shopping, making a mobile-first strategy ideal for engagement.

- Looks for a one-stop solution for all her beauty and wellness needs, making Nykaa’s wide product variety and convenience appealing.

- Will switch to a competitor for better discounts, faster deliveries, or concerns over product quality, suggesting price sensitivity and quality concerns.

- Likely to purchase products with trusted, quality ingredients and skincare benefits, meaning that Nykaa must ensure product transparency and credibility.

- Enjoys shopping experiences that are efficient, quick, and user-friendly, especially over platforms that could offer counterfeit products like Amazon.

Segmentation 2: Casual, Core, Power Customization Framework

Segmentation 3: Advanced segmentation ( RFM framework)

Product Hook

Problem Statement

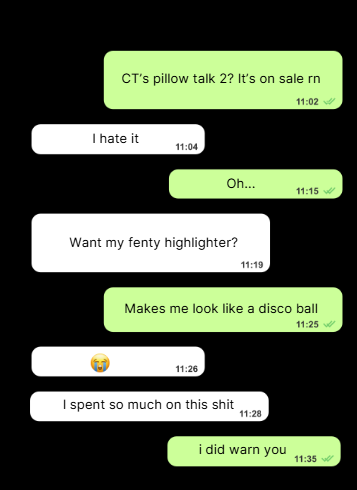

🛑 Beauty Shopping is Social, But Scattered

- Users rarely shop for beauty products in isolation—they seek recommendations, ask friends for opinions, and discuss products on WhatsApp, Instagram DMs, or in person before purchasing.

- Nykaa currently lacks a seamless in-app experience to facilitate these interactions.

- The influencer marketing gimmicks have been so overdone that people no longer trust their recommendations.

- Humans from the beginning of time have been influenced by peers in their immediate circles.

How does social layer in shopping help & why?

Shopping within social circles works because

- It leverages the power of social influence, where people are more likely to buy products when they see others they trust, like friends or influencers, recommending or using them.

- Creating a sense of validation and trust in the purchase decision, especially when combined with authentic content and peer-to-peer recommendations.

What is the proposed feature to solve for this issue in hand?

Adding a separate section on the app that only caters to the social layer on the app. This will make the whole experience more fun, collaborative and something people will look forward to bonding over. This in turn will increase the time spent as time spent on whatsapp and instagram having the same discussions will directly moved to Nykaa's app.

This will be dedicated solely to building a community, building engagement and getting people together.

What metrics does this issue solve for?

- Average sessions time

- Average session frequency

- Order frequency

- Order AOV

- Revenue

This can be tackled in 2 ways and both in their own ways will help scale engagement, retention and in term revenue for Nykaa

Let's look at each of the

Case 1 :

User shops alone, uses social layer for support and decision making

Case 2 :

User shops in groups to avail discounts.

This can further be executed in 2 ways

Case 2A

Best for cases where all participants live within the same vicinity/ area - get product shipped to 1 person's house and internally figure out the logistics from there.

Will work for the following TGs

👉College / Undergrad circles/ Campus groups

👉Kitty party friends

👉Office peer group

👉Close Knit circle of friends & family

👉Distant connections- say ladies group in a colony/ gated society.

Case 2B -

Shipped directly to each participant's house. No logistic hassles whatsoever.

Works best for

- Friends / Family -not in the same location

- Facebook groups/ Reddit groups

- Friends + connections you make in Nykaa community

Steps involved in the Group shopping feature

For this to work best- Nykaa must also give group deals/ bulk deals to consumers- not in super stores alone.

Existing proof of Concept

Group buying on app -bluewill

Group buying on app -bluewill

Group purchases on the Bluewill app allow users to collaborate and buy products at discounted prices. Here’s how it works:

- Create or Join a Group: Start a new group or join an existing one for a product.

- Set a Product: Choose a product, with the price dropping as more people join.

- Invite Others: Invite friends to join the group and unlock better deals.

- Payment: Once the group reaches the required number of members, everyone pays at the reduced price.

- Delivery: The product is shipped to all members after payment.

It’s a great way to save by shopping together!

Engagement Campaigns

Engagement # Campaign 1

For users who shop infrequently and are price sensitive

ICP 1- Riya even asked for a feature that would make share-ability easier.

Engagement #Campaign 2

To increase frequency of purchase for core users.

Engagement # Campaign 3

To alert users when the product they were previously looking for is back in stock

Engagement # Campaign 4

For a new user that has only placed one order with Nykaa since app was installed

Engagement # Campaign 5

For users who order infrequently from Nykaa

Section at a Glance :1.Understanding retention for Product (Nykaa)

Broad Overview

👉Current Retention Trends

👉Understanding when retention curve flattens

Microscopic View | Detailed Analysis of Parameters that drive retention

👉What acquisition channels drive retention?

👉What sub-features & sub products drive retention?

👉What user segmentation is the most valuable for retention?

👉What ICP persona should we target?

2. Defining Retention for Product (Nykaa)

👉What are the top reasons for churn?

👉What are the negative actions to look out for?

Section at a Glance :1.Understanding retention for Product (Nykaa)

Broad Overview

1.Understanding retention for Product (Nykaa)

Broad Overview

👉Current Retention Trends

👉Understanding when retention curve flattens

Microscopic View | Detailed Analysis of Parameters that drive retention

👉What acquisition channels drive retention?

👉What sub-features & sub products drive retention?

👉What user segmentation is the most valuable for retention?

👉What ICP persona should we target?

2. Defining Retention for Product (Nykaa)

2. Defining Retention for Product (Nykaa)

👉What are the top reasons for churn?

👉What are the negative actions to look out for?

1. Understanding Retention for Product

Broad Overview

1. Understanding Retention for Product

Current Retention

There are 2 parts to Nykaa’s retention

👉1. Customer Retention on App + website📱

👉2. Customer Retention for Nykaa as a brand 🛍️

We will only be looking at App + website Retention here for the following reasons:

👉Nykaa as a brand would entail its entire portfolio comprising of Nykaa retail, Nykaa fashion and so on.

👉Since the product selected for this project is only Nykaa shopping app- it makes sense to review this in isolation.

App retention can be broken down into

👉Case 1 : For New Users

👉Case 2 : For Long term users

as the behavior of each of them towards the app would be different and would result in different retention rates.

Case 1 : New Users

Here's a comparison of Nykaa and its competitors in its beauty space. ( Using Amazon and Myntra for benchmarks)

Insights from Graph above

👉Amazon is a super shopping app for almost all needs while Nykaa is restricted to the BPC space alone.

Hence the lower retention for Nykaa as opposed to Amazon makes sense.

👉 Nykaa has a higher retention than its direct competitors- Purplle and Tira.

According to Onesignal- As per industry standards, a shopping app’s retention looks like this

Basis this graph, lets plot and compare Nykaa's retention against Industry standards to gauge how Nykaa is performing.

As per sensor tower, Nykaa’s Retention chart looks like this

The retention curve starts to flatten on day 79 @ 5.75%

This means that on an average new users take upto 79 days to experience value in the product.

about 6% of users that installed the app stick around to experience the core value prop.

Case 2 : For Long term users

For this we will track user behavior over a timeframe of a year using a combination of average MAU data & Number of total registered users

Here's what the data for this looks like as per sensor tower

Basis this now let's plot the graph.

Insights from Graph Above

👉If the retention rate fluctuates YoY instead of flattening, it indicates inconsistent user experience, external market shifts, changing acquisition strategies, and product/marketing experimentation impacting user loyalty year-on-year.

👉For Nykaa retention was almost flattening at 42-45% by 2020 however things took a turn and is now seeing fluctuations only- no flattening. Basis Insights & Secondary Research, here's what potentially happened/ is happening to/ with Nykaa :

Case 2 : For Long term users

Case 2 : For Long term users

For this we will track user behavior over a timeframe of a year using a combination of average MAU data & Number of total registered users

Here's what the data for this looks like as per sensor tower

Basis this now let's plot the graph.

Insights from Graph Above

👉For Nykaa retention was almost flattening at 42-45% by 2020 however things took a turn and is now seeing fluctuations only- no flattening. Basis Insights & Secondary Research, here's what potentially happened/ is happening to/ with Nykaa :

Microscopic View

Which acquisition channels drive retention?

The Channel Overview provides a breakdown of a website or app’s traffic sources.

The Channel Overview provides a breakdown of a website or app’s traffic sources.

The highest channels are -

- Direct

- Organic

- Social

- Ads -Paid search

- Emails

What does high traffic from Direct Channels mean for retention of Nykaa?

- Brand trust and habitual use: Frequent direct visits suggest that Nykaa has become a habitual choice for users, improving long-term retention.

- Strong customer loyalty: Users returning directly indicate that they are deeply connected to Nykaa, which fosters higher retention.

- JBTD Met: Nykaa is fulfilling the users' Jobs to Be Done (JBTD), making it their go-to platform for beauty, leading to strong retention and loyalty.

Some conclusions that can be drawn from the above learnings are:

👉Given Nykaa’s strong brand pull and customer loyalty, small, timely nudges can significantly drive retention.

👉Since 95% of Nykaa users are on mobile, these nudges can be triggered via

Other channels that drive retention are as follows

The identified nudges could then be triggered through the following channels -

- Push notifications

- Pop ups

- Email marketing

- WA ( Whatsapp)

- Retargetting specific cohorts through paid ads

Ads on Instagram

Ads on Instagram

Nykaa's affiliate network also serves as channel that drives retention

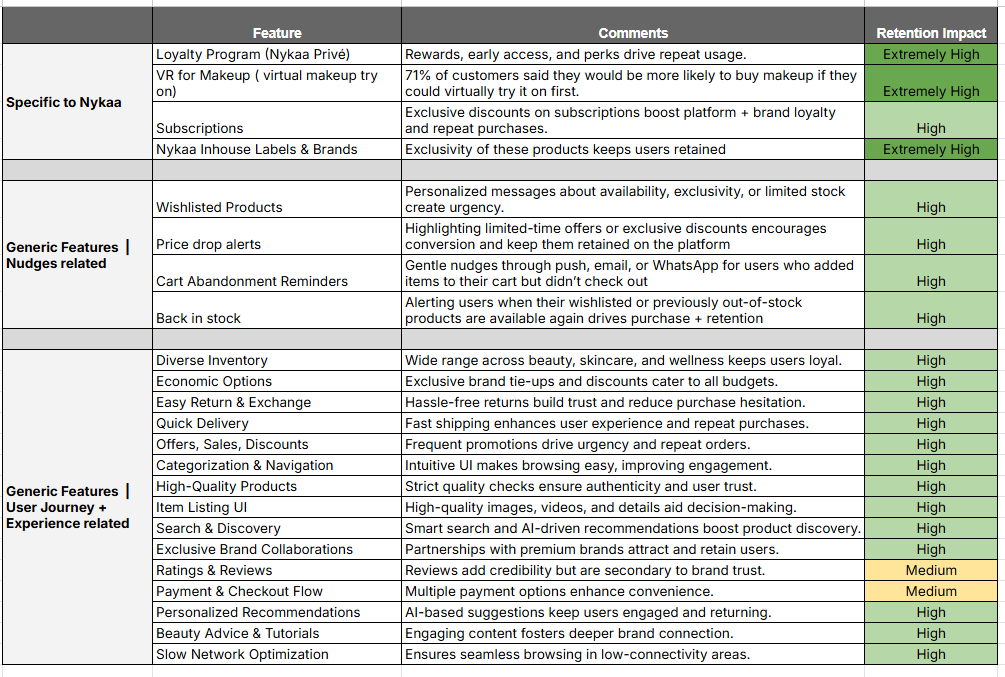

What sub-features drive retention?

List of Nykaa's inhouse brands- a sub product/ feature of Nykaa that are exclusive to the platform and automatically drive retention-

List of Nykaa's inhouse brands- a sub product/ feature of Nykaa that are exclusive to the platform and automatically drive retention-

Which ICPs drive retention?

Power Users:

- Highly engaged beauty enthusiasts who frequently explore trends and products, driving top retention rates.

- They order 2+ times a month with an AOV of 2500-5000 depending on needs.

- Their high engagement levels, frequent purchases, and active participation in the beauty community drive the best retention rates.

Core Users:

- Regular shoppers who buy based on needs or occasions, ensuring steady interactions and retention.

- Their order value may differ from 3500 t0 6000 but the frequency and depth of their visits are significantly on the higher sides and consistently at least once every month.

2. Defining Retention for Product (Nykaa)

2. Defining Retention for Product (Nykaa)

What are the reasons for churn?

A churned user for Nykaa is someone who previously engaged with the platform (browsing, purchasing, or interacting with content) but has stopped using it for an extended period.

Here are top reasons likely to result in churn for a Nykaa user.

What are the negative actions to look out for churn?

Here are some actions that indicate a user has churned/ is likely to churn:

Let's now look at what the negative actions could be indicating, and what is the probability of a user churning post these actions.

Customer resurrection campaigns are designed to win back customers who have drifted away from a brand for various reasons, such as dissatisfaction, competition, or changing preferences and maybe compliance breach in some cases. ( All the reasons listed in the list of voluntary churn activities)

This effort goes a long way in rebuilding trust.

Let's look at campaigns to help resurrect churned Nykaa users.

Resurrection #Campaign 1

For users who have raised a complaint recently

Resurrection #Campaign 2

For users who have disabled notifications.

Resurrection #Campaign 3

For users suffering from choice overload/ paralysis & not ordering.

Resurrection #Campaign 4

For users who stopped placing orders as per their expected frequencies ( Power )

Resurrection #Campaign 5

For ensure users place orders as per their expected frequencies ( Core )

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.